The Liquidity Update: what does it mean to be a public company?

Goldman’s Family Office Report • UK Pension Funds Exploring Venture • Software Pricing Multiple • Secondaries Lead in Capital Raising • Semper’s New Tool • Interview with Elisa from Akkadian

Welcome to Semper’s newsletter for investors. Each month, we’ll provide updates on the latest in secondaries across venture and growth and the broader theme of private market liquidity.

Goldman Sachs releases 2023 family office investment insight report

Goldman’s report emphasizes that due to recent valuation adjustments in the technology sector, numerous family offices are keen on seizing opportunities to invest in companies facing temporary valuation pressures while possessing long-term value potential. According to their survey:

Growth is the preferred private equity strategy among family offices (92% invest)

Secondaries are part of the strategy for 60% of family offices, but only 25% of those invest directly, the rest rely on managers

The number of FOs who believe their portfolios are overweight in tech (43%) is over 2.5x the number who believe they are underweight (16%) which might prompt some selling pressure in the coming quarters

(Full report: Goldman Sachs)

Will UK pension funds finally explore venture capital?

Several conversations have started in UK government circles in an attempt to attract and retain its best companies. The failure of convincing Arm to list in London and CRH’s migration to US capital markets seem to have served as a wake-up call for Labour and The Conservatives. Pensions have all but disappeared from the UK equity markets (allocation shrunk from ~50% in the 1990s to under 2% today) and growth equity is still almost absent from their portfolios, unlike Canadian or Australian counterparts.

As a result, Labour is exploring the creation of a £50bn “future growth fund” in which pension funds would be compelled to invest. The proposal also pushes for a consolidation of the British pension landscape which remains inefficiently fragmented.

(Article: Financial Times)

London Stock Exchange announces launch of Intermittent Trading Venue

The London Stock Exchange has been struggling to attract fast-growing technology companies, losing favour to New York-based alternatives. In an attempt to build deeper and earlier relationships with the leading companies of tomorrow, they’ve announced the launch of an Intermittent Trading Venue for 2024.

As the press release states, “this market will enable companies to stay private if they want to, while providing structured and efficient liquidity in their existing shares at predetermined, infrequent intervals.”

They also share an interesting fact highlighting the importance of scale-ups to the UK economy: “the 34,000 scaleups in the UK contribute £1.2 trillion to the economy, whilst six million other small and medium sized companies contribute another £1.1 trillion. Put another way, just 0.6% of the SME sector accounts for one third of the UK economy.”

(Source: London Stock Exchange Group)

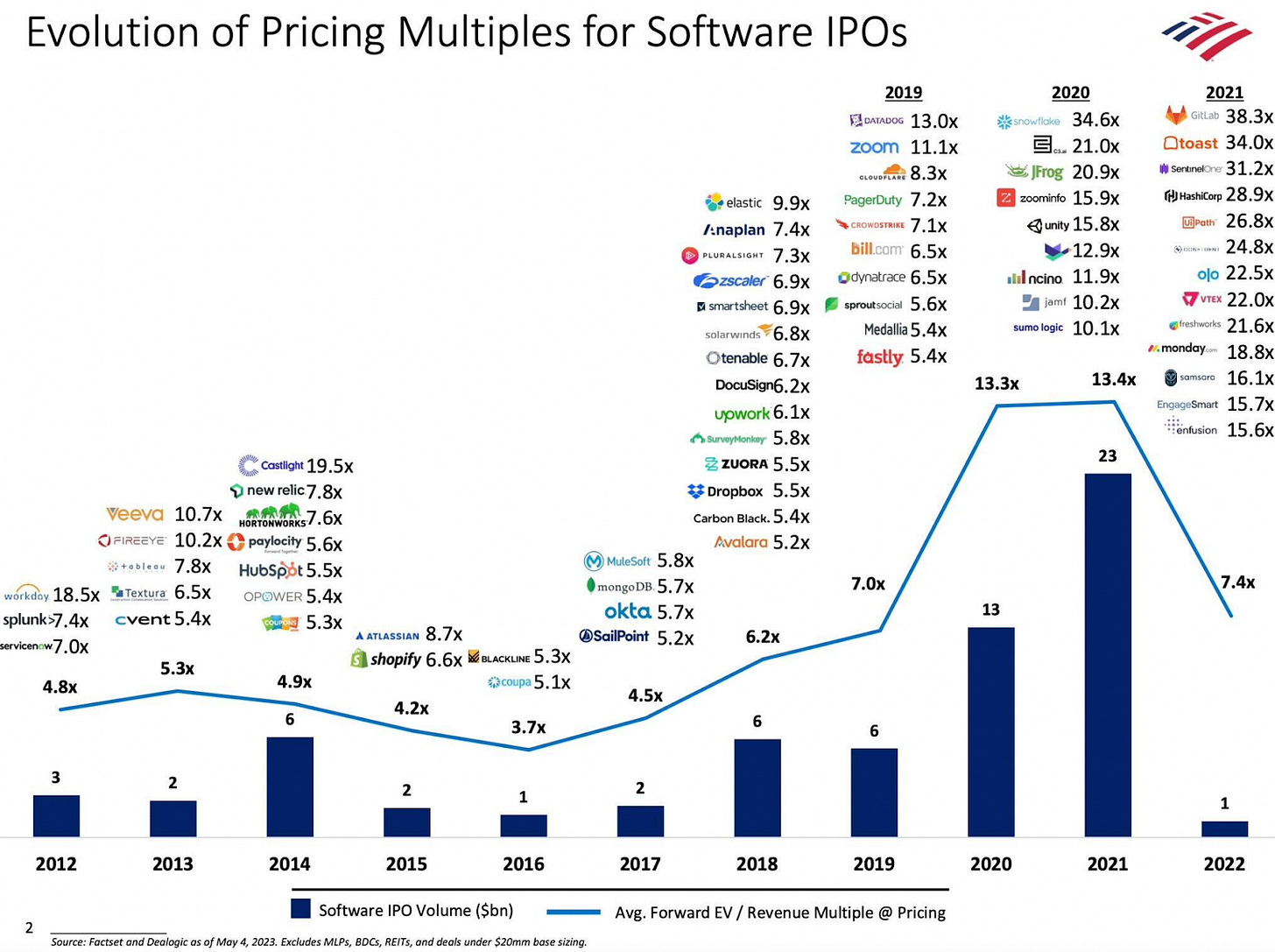

Chart of the month: evolution of multiples for software IPOs

To put the ’19-’21 bull market in perspective: the top multiple of all software IPOs between 2012 and 2019 would barely have made it to the top 10 of 2021 IPO graduates. The 2022 correction is best exemplified by the more than 95% fall in funds raised by software companies on public markets.

Tiger Global selling its private portfolio: watershed moment for valuations?

Tiger Global has mandated Evercore to support it in off-loading some of its private market investments. With its aggressive deployment over the past 5 years, Tiger’s portfolio includes many of the most valuable private tech companies, where it is a co-investor with many other top funds. GPs and LPs alike will be monitoring closely where those companies end up trading, as it will be hard to avoid incorporating those prices into their internal valuations.

Private equity and growth funds are increasingly looking at the seco

ndary market to find a liquidity mechanism that will return money to their LPs while public markets remain closed and M&A activity quiet. This trend in portfolio sales is expected to continue in the next few months.

(Article: Secondaries Investor (paywall, email for access) Financial Times)

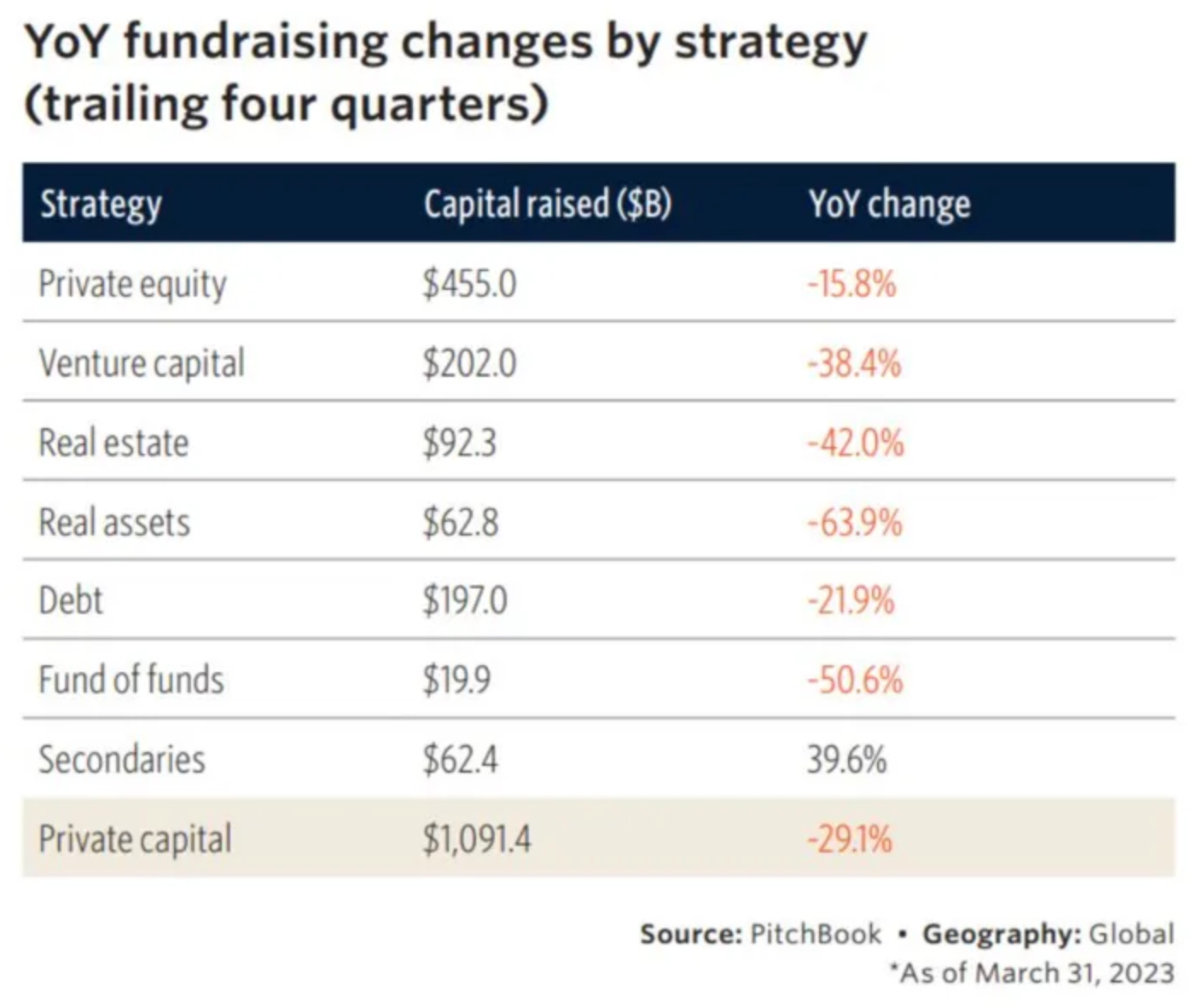

Secondaries outperform other strategies in terms of capital raised

After blockbuster fundraising in the lead-up to 2022, most sub-strategies within private markets saw a significant decrease in the amounts raised, with the notable exception of secondaries. In the year ending in March 2023, over $60B was raised for secondary strategy, underlining LP appetite for opportunities to provide liquidity to distressed sellers and end-of-cycle funds.

Private equity firms offload public holdings at a discount to IPO prices

Blackstone recently sold shares in Bumble (dating app) at ~50% below its IPO price. As one senior banker puts it in the article: “The view that firms can’t do a deal unless there’s been a specific return since the IPO or if it’s below where they’ve sold stock in the past, I think that’s gone out the window.”

Will similar behaviour become more commonplace for private assets?

(Article: Financial Times)

A New Tool from Semper: Public Comparables of Private Companies

Where do private companies stand compared to their public peers?

Private market prices continue to maintain their high valuations, with discounts usually below 30% compared to the previous funding round. In contrast, many unprofitable public companies experienced declines of 75% or more from their all-time highs.

This seems to be the result of selection bias; only the best private companies like Stripe, Dataiku, and Snyk were able to achieve successful offerings, with some receiving double-digit discounts (e.g. Stripe at ~50% discount). However, most other loss-making growth companies would have faced even larger discounts had they tried to raise. In addition, the structure of deals sometimes obscured the true valuations, as investors are willing to pay higher “sticker” valuations if they receive favorable terms such as a 2x liquidation preference.

To bridge the valuation gap between public and private companies, we are excited to introduce our new Comparables tool.

We currently offer comparables for the top leading private European companies and will continue to add new companies in different geographies & industries.

Please check it out, we’d love to get your feedback!

https://comparables.meetsemper.com/

Investor Profile: Elisa Karsenty Amar, Investor at Akkadian

Each month we interview one of our favourite institutional investors. Interested in taking part? Get in touch at reading@meetsemper.com

For more than a decade, Akkadian has pioneered secondary and opportunistic investments in growth-stage technology companies. Elisa is covering Europe and Israel sourcing growth stage VC deals across those regions.

1/ How did you personally get into investing?

I grew up in Israel surrounded by entrepreneurs and investors. In Israel, investments and tech are part of the day-to-day conversation, and I wanted to be part of this enormous thing. During my final year of university, I enrolled in the Zell entrepreneurship program. In conjunction with Zell, I founded a startup that gave small to medium investors access to emerging funds. This venture accelerated my interest in investing, and when I had the opportunity to join Akkadian, I jumped at it.

2/ How long has your firm/have you been involved in the direct secondary market?

Akkadian was founded in 2010 and is one of the pioneers in the secondary market. For our first two funds, we started investing in small direct secondaries between rounds. Then, Facebook, which was still private, started allowing employees to sell its private company stock, and the entire market exploded. Since then, Akkadian has expanded into option-exercise loans, whole company liquidity programs, and special situations.

3/ Where do you see the biggest opportunity in the secondary market at the moment?

We focus on direct secondaries in technology companies between $10M - $100M of revenue. In 2021, technology companies raised massive rounds at extremely high valuations, and as a result, good companies are flush with cash. The market is different today. Because the prices that growth investors are willing to pay have dramatically decreased, few well-funded companies are raising capital, which prevents primary funds from investing in them. In contrast, the secondary market gives Akkadian potential access to exciting growth-stage companies at prices that we feel are appropriate in the current macro environment. Many angel investors, employees, and seed funds need liquidity. The key is to have the necessary information to make purchases when opportunities arise.

4/ On a scale of 1 to 10, how much do you think of downside protection?

In our view, the best downside protection is investing in great companies that hit their projections. That said, we often enter companies via investments in primary rounds, which include the typical liquidation preferences associated with preferred stock. On occasion, we successfully structure the transaction so that the company exchanges our secondary common stock for preferred stock with the typical downside protection. In addition, when we make option exercise loans covered by additional collateral, our capital is potentially protected against 50% - 80% price reductions. When we have a potential deal involving common stock without downside protection, we carefully scrutinize the capital structure and future financial needs of the company. Then, we only proceed when we think the value of the company is likely to clear the preference stack, and the shareholders will convert to common at exit.

5/ How do you think of the time-to-liquidity?

Our average time to liquidity has been approximately four years. Naturally, in this environment, that four-year timeframe is likely to increase. Many companies have postponed their IPOs, and employees and early investors have to readjust their liquidity expectations. Based on NAV, approximately half of our portfolio is in companies that have more than $100M of revenue, which implies that a significant portion of our portfolio is ready for liquidity. Based on the above, we must simply wait for the liquidity window to open, but nobody can claim with any visibility when that will be.

6/ Will direct secondaries go mainstream? If so, what will the tipping point be? Do you expect more involvement from primary investors into secondaries?

For secondary firms that are entrenched in Silicon Valley, direct secondaries are already mainstream. Lately, many more brokers and outside buyers are seeking pre-IPO opportunities by buying highly visible companies without information. We don’t participate in the “no information” market. At Akkadian, we believe that access to information and expertise in the field creates an investing advantage.

Given the large amounts of capital raised by Mega Funds in the past few years, we expect that these funds will more aggressively buy Pre-IPO stock and could potentially provide the venture capital with market liquidity at scale. The Mega Funds need to put that capital to work, and large secondaries could create opportunities for them while the IPO window is closed. A core part of our strategy is to build our position before the Mega Funds invest and have optionality around selling to them.

7/ How do you currently originate your deal flow in the secondary space?

We have both outbound and inbound - we work heavily on analyzing our target companies, and we also have the opportunity to work with great partners who send us opportunities. In 2021, we added Mike Dinsdale to Akkadian. Mike was the CFO of Docusign, Doordash, and Gusto through their hyper-growth phases. Many companies want him involved. We also run the largest conference for emerging venture capital firms - Raise Global - which provides access to small venture capital funds. Finally, we use in-house technology to monitor over 20 brokerages for shares in our existing portfolio companies to find potential opportunities to add to those positions.

8/ Do you expect private and public valuations to converge this year?

Do you expect secondaries to play a role in this?

There is no simple answer to this question. For the small number of the best high-growth technology companies raising primary capital, competition between the large funds has maintained elevated prices in comparison to the public markets. Even a year into this contraction, we still see primary deals closing at prices that are hard to justify based on traditional public market valuations. In the secondary market, however, we are often seeing discounts in the 40% - 60% range when compared to the last primary offering. As a result, the secondary market is already trading at prices that are consistent with public market valuations.

Semper partners with leading private companies and gives them control of their secondary market. To learn more or sign up to our portal, click here. Semper does not provide investment advice.

Semper Unitas Limited is an Appointed Representative (Firm Reference Number: 963550) of Khepri Advisers Limited (Firm Reference Number 692447) which is authorised and regulated by the Financial Conduct Authority.